Digital Fiscal Services

An essential revenue-raising platform for governments

Integrated accounting tool generates all required tax filings

Businesses can register for government assistance packages

Why it matters

The economic consequences of Covid have increased the pressure on governments to provide essential services and support to their citizens. Yet many tax systems are out-of-date, complicated to understand and difficult to manage, meaning governments miss out on much-needed revenue, while retaining unreliable economic data.

At the same time the complexity of many tax systems is a significant cost, which discourages small businesses from registering and declaring. This simple online tool aims to make it easy for businesses to pay their taxes and access subsidies and incentives.

Case study

Cuenta MYPE MSME account in

El Salvador:

Automatic filing for licenses, taxes,

and social security

and social security

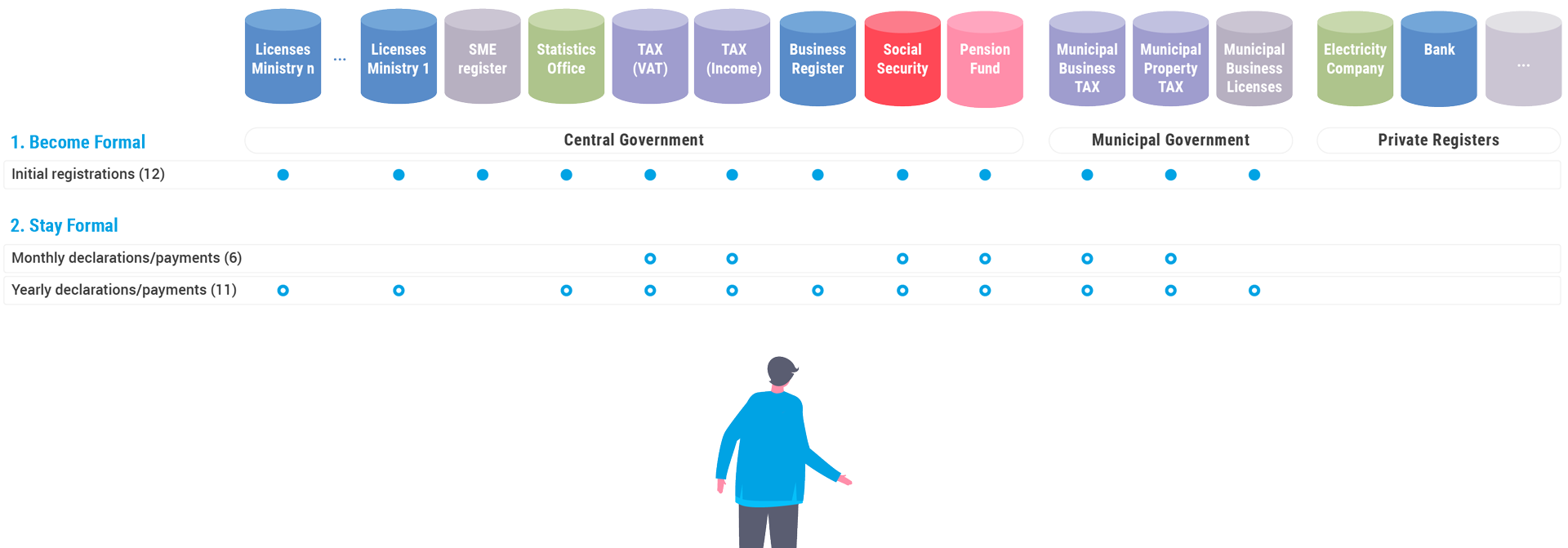

Businesses that register through a single online form on Cuenta MYPE are automatically registered with up to 12 ministries, agencies, tax departments and social security funds, both at national and municipal levels.

The system also integrates an application for registered companies to file their accounts online. This automatically generates the legally required 6 monthly and 11 annual filings for users to submit electronically. New services, such as Covid subsidy applications, can also be added.

Entrepreneurs save significant time and money, find it easier to file their taxes and social security on time, and make fewer errors.

A common digital platform means company data can be crosslinked with fiscal and labour data allowing the economic and social impact of entrepreneurship policies to be measured, which in turn can help support governments’ growth and development objectives.

Advantages

- Businesses can manage their tax payments easily, accurately and promptly.

- Governments increase tax revenues to provide for citizens’ needs, and can use filled data to design policies that better support sustainable development.

Beneficiaries

Digital fiscal services are available to any government and can be implemented within existing laws.

Countries

- El Salvador, Tax and social security and national and municipal levels

Installation process

STEP 1

Analysis

The project team analyses with government officials tax requirements at the national, provincial and municipal levels as well as registration and payment procedures (3-4 months).

STEP 2

Development

The project team develops the country platform (1 month concurrently).

STEP 3

Implementation

The project team creates online procedures on the platform (2 days to one week for each procedure depending on complexity and number of agencies involved).

STEP 4

Training

The project team trains government staff to operate and maintain the system (12 months concurrently).